June 5, 2017, Posted by Anton Papp

Paying premiums for acquisitions or investments is commonplace in the technology industry. When I was global head of corporate development for Teradata, we did several of those, such as acquiring Aster Data and Hadapt or investing in Hortonworks or Revolution Analytics.

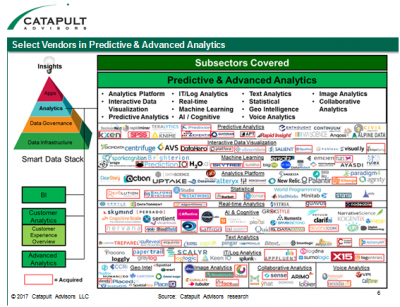

I am now a Partner at specialized investment bank Catapult Advisors, leading the firm’s initiatives in the broader big data & analytics market, which we call “Smart Data.” Despite the commonality of premium transactions throughout the tech industry, I’ve never before seen such volume of premium deals in a space as narrow as predictive and advanced analytics.

The number of private vendors in this market make up less than one-third of the 1,000+ private companies we are tracking throughout our Smart Data stack. Yet these companies have accounted for the majority of truly strategic acquisitions—deals that were highly valued based on their technology rather than commercial traction. Consider this: since January 2015, acquirers have collectively spent $1.6bn on nine strategically valued deals; those targets, in aggregate, generated less than $50MM of annual revenue prior to their sale.

This is good news for predictive and advanced analytics startups. Transactions such as Apple acquiring Lattice Data for $200M or Cisco buying MindMeld for $125M, as well as DataRobot’s $54M and Looker’s $81.5M financings, are giving confidence to the sector’s CEOs, especially those considering their strategic options. However, those CEOs, as well as potential investors and acquirers, are still unsure how to navigate this valuable but fast-moving and highly complex market segment.

We’ve put together a proprietary research report on predictive and advanced analytics companies, trends, and technologies to contextualize the market and to help all its stakeholders identify strategic opportunities. Click here to view that report.

And if you’d like to learn more about market dynamics in predictive and advanced analytics or if you want to discuss how to optimize your M&A or capital raising strategies, please email me at apapp@catapultadvisors.com.

Catapult Advisors is an investment bank based in San Francisco that has been providing M&A, capital raising, and corporate development advisory services to emerging software companies for 15 years. Our Smart Data Initiative’s goal is to better understand the broader “big data and analytics” market, it’s 1,000+ private companies, the interests of the large strategic acquirers, and the interests of growth-stage investors. By combining this deep sector expertise with our extensive transaction, corporate development, and operational experience, we are able to provide value-added M&A and capital raising advice to our clients.

The initiative is led by Anton Papp and Ron Lissak, 30-year veteran of the investment banking industry. Market intelligence and transaction support is provided by former 451 Group corporate development research analyst Ben Kolada.

To learn more about Catapult’s Smart Data Initiative, click here.

Anton Papp is a Partner at investment bank Catapult Advisors. Previously, he was Vice President of Corporate Development at Teradata, responsible for global M&A and strategic investments. Before Teradata, Anton was Vice President of Corporate Development & Global Alliances at enterprise marketing software provider Aprimo, where he orchestrated Aprimo’s sale to Teradata for $525MM. Anton was previously an investment banker and began his career as a Naval Aviator flying the F-14 Tomcat. Anton holds a BSEE from Boston University, an MBA from Columbia Business School, and is a graduate of the Navy Fighter Weapons School (“Top Gun”).